Vita Group secures £43m funding for third Newcastle city centre student housing scheme

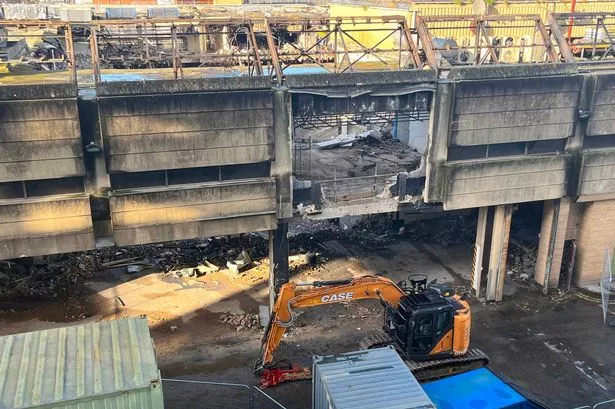

A £43m funding package is driving forward a new student accommodation scheme in Newcastle. Puma Property Finance has announced it has given a the multimillion-pound loan to Vita Group to fund the development of its third student accommodation project in Newcastle. Vita Group is constructing the property on Leazes Park Road, having struck a deal for the site of former Barker and Stonehouse furniture store. Demolition teams have been busy clearing the site to make way for Vita Student Leazes Park, a 260-bed purpose build student scheme, after the luxury furnishing company moved out, having sold it for more than £5m. Puma Property Finance has announced it has given a the multimillion-pound loan to Vita Group to fund the development of its third student accommodation project in Newcastle, which sits close to the Newcastle University campus and Northumbria University’s main campus. New images have been released by the operator, showing how Vita Student Leazes Park will have amenities including a gym, bookable private dining and study rooms, a private landscaped courtyard and basketball court. Every bedroom will also have a high-quality fit-out, and floor to ceiling windows. Developers and operators Vita Student plan to have the new building ready for students to move in ahead of the September 2026 academic year. The scheme is Vita’s third student development in Newcastle, based close to its other sites in Strawberry Place and on Westgate Road, close to central station. The company’s first building in the city was launched around 10 years ago, when Vita Westgate was created on land once occupied by the former Westgate House, a building which was knocked down in 2007 following a campaign for its demolition. The neighbouring Norwich Union House was also taken down to make way for the new structure. The £43m deals marks the third scheme that Puma has partnered with Vita on, having previously given the business a £24m loan for a 269-bed development in Belfast in September 2022 and the December 2024 Edinburgh development. Max Bielby, chief operating officer for Vita Group, said: “This development in Newcastle marks our third in the city and we are delighted to be continuing to provide incoming students with high-class accommodation and facilities. We are looking forward to seeing this development come to life over the coming months in partnership with Puma.”